Extension of period for utilisation of the pre-printed packing material stock

DATE: 8th June, 2021

WM-10(22)/2020

Government of India

Ministry of Consumer Affairs, Food and Public Distribution

Department of Consumer Affairs

Legal Metrology Division

To,

The Controllers of Legal Metrology, All States/ UTs

Krishi Bhawan, New Delhi Dated: 08.06.2021

Subject: Extension of period up to 30.9.2021 for utilisation of the pre-printed packing material stock due to prevalent situation of COVID-19 – reg.

Sir,

The undersigned is directed to refer to the above mentioned subject and to state that due to prevalent condition of COVID-19, leading to the lockdown of the whole country the manufacturing activities have come to a grinding halt. Consequently, the inventory of packaging material / wrapper with pre-printed date of manufacturing is not expected to be exhausted within the time limit prescribed under Rules.

| Click here to view details |

- Published in Notifications

Exemption for import of Used critical medical equipment for re-use

F.No.23/8/2021-HSMD

DATE: 10th June, 2021

Government of India

Ministry of Environment, Forest and Climate Change

(HSM Division)

OFFICE MEMORANDUM

Subject: Exemption for import of Used critical medical equipment for re-use (Basel No. B1110) under Hazardous and Other Wastes (Management and Transboundary Movement) Rules, 2016 – reg.

| Click here to view details |

- Published in Notifications

No. SMTA/JUNE-17/COND. 17th June, 2021

No. SMTA/June.17/COND.

17th June 2021

With profound grief & sorrow, we regret to inform you the sad demise of Smt. Indra Rani Talwar M/o Sh. Krishan Talwar & Sh. Mahesh Talwar, of M/S. United Surgical Industries, New Delhi on 17th June, 2021.

Keeping the pandemic situation in mind we would request all members to pray for the departed soul

- Published in Condolences

SMTA/June.2021/EBM/Rate Notification COVID

DATE: 14th June, 2021

MINISTRY OF FINANCE

(Department Of Revenue)

NOTIFICATION

New Delhi, the 14th June, 2021

No. 33/2021-Customs

G.S.R. 401(E).—In exercise of the powers conferred by sub-section (1) of section 25 of the Customs Act, 1962 (52 of 1962) and section 3 of the Customs Tariff Act, 1975 (51 of 1975), the Central

Government, on being satisfied that it is necessary in the public interest so to do, hereby rescinds the notification of the Government of India in the Ministry of Finance (Department of Revenue) No. 30/2021- Customs, dated the 1st May, 2021 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 313(E), dated the 1st May, 2021, except as respects things done or omitted to be done before such rescission.

[F. No. CBIC-190354/63/2021-TO(TRU-I)-CBEC]

RAJEEV RANJAN, Under Secy

| Click here to view details |

- Published in Notifications

SMTA/June.2021/GST Updates

SMTA/June.2021/GST Updates

12th June 2021

GST Updates

Good morning.

To give effect to the decision taken at 43rd GST Council meeting, GST department has issued few notifications on 1st June 2021.

1. Notification no 16/2021 ( payment of interest on delayed filing of GSTR 3B)

Section 50 of CGST Act which governs payment of interest has been amended w.e.f 1st July 2017. Registered person will now be required to pay interest on tax paid through electronic cash ledger. No interest to be paid on tax paid through ITC.

2. Notification number 17/ 2021

The last date for filing GSTR-1 return for May 2021 has been extended till 26th June 2021.

3. Notification no 18/2021

Interest payment for delay in filing GSTR-3b –

A Registered person having turnover of more than Rs 5cr in preceding year – 9% interest p.a. for first 15days after due date of filing of GSTR 3B and 18% interest p.a. thereafter for the month of March, April and May.

B. Registered person having aggregate turnover upto Rs 5cr in last year –

For March 2021 – No interest for first 15 days after the due date of filing of GST 3B, 9% pa for next 45 days and 18% pa thereafter.

For April 2021 – Nil interest for first 15 days from the due date of filing GSTR-3B, 9% pa for the next 30 days and 18% pa thereafter.

For May 2021 – Nil interest for first 15 days from the due date of filing GSTR- 3b, 9% pa for next 15 days and 18% pa thereafter.

C. Registered person filing GSTR – 3b on a quarterly basis – No interest for the first 15 days from the due date of filing GSTR- 3b for quarter March 2021, 9% pa for the next 45 days and 18% pa thereafter.

4. Notification no 19/2021 ( waiver of late fees for GSTR 3B for March, April and May 2021)

a. Registered person having aggregate turnover of more than Rs 5cr in last year –

No late fees for the first 15 days from the due date.

b. Registered person having aggregate turnover upto Rs 5cr –

For March 2021- No late fees upto 60 days from the due date.

For April 2021- No late fees upto 45 days from the due date.

For May 2021- No late fees upto 30 days from the due date.

c. Registered person filing quarterly GSTR- 3b – No late fees upto 60 days from the due date of filing return for March 2021 quarter.

d. Amnesty scheme-

Those who have not filed their GSTR- 3b for any month or quarter from July 2017 till April 2021 can file the return before 31st August 2001 with the late fee of Rs 1000 per return.

If the tax payable in any return is Nil, then the late fees shall be Rs 500 per such return.

e. Maximum late fees for delay in filing GSTR-3b from June 2021 onwards-

If tax payable is Nil then maximum late fees shall be Rs 500 per return

If turnover in the last year is upto Rs 1.50 crore, then maximum late fees shall be Rs 2000 per return.

If turnover in last year is is up to Rs 5 crore, then the maximum late fees shall be Rs 5000.

5. Notification no 20/2021

Maximum late fees for delay in filing GSTR-1 from June 2021 onwards-

If there is no outward supplies during the month/ quarter, then maximum late fees shall be Rs 500.

If the turnover during last year is upto Rs 1.5 crore, then maximum late fees shall be Rs 2,000.

If turnover during last year is upto Rs 5 crore, then maximum late fees shall be Rs 5000.

6. Notification 26/2021 ( Filing of Job Work return)

All Registered person can file ITC 04 for Jan – March 2021 till 30th June 2021.

7. Notification 27/2021 (Availment of ITC and filing of IFF for April 2021)

a. Registered person can claim ITC for April and May 2021 as per their books without following GSTR 2A. However, while filing GSTR 3B for June 2021, it need to ensure that it has availed ITC for April, May and June, put together , as per GSTR 2A plus 5%.

b. Registered person filling quarterly GSTR 1 can file outward supply details in IFF for May 2021 from 1st June till 28th June 2021. Earlier the due date was till 13th June 2021.

| Click here to view details |

- Published in Notifications

OM revised MRP for Oxygen Concentrator

File No. 20(8)/38/2021/Div.III/NPPA

9th June 2021

Government of India

Ministry of Chemicals & Fertilizers

Department of Pharmaceuticals

National Pharmaceutical Pricing Authority

OFFICE MEMORANDUM

The Government vide Gazette Notification No. 216I(E) dated 3rd June 2021 has capped Trade Margin at Price to Distributor (PTD) at 70% for Oxygen Concentrators. It was further notified that the prices are to be revised by the manufacturers / importers as per the formula prescribed in the aforesaid notification and the revised prices shall be effective from 9th June 2021.

| Click here to view details |

- Published in Notifications

SMTA/April.2021/EBM/MIN-11

SMTA/April.2021/EBM/MIN-11

DATE: 24th May, 2021.

MINUTES

Pursuant to the Agenda Notice dated 3rdApril, 2021 the 11th Executive Body Meeting of The Surgical Manufacturers and Traders Association was held Online by video conferencing on 11th April, 2021 at 07.00 PM. Following members were present:

1. Mr. Pradeep Chawla (In the Chair)

2. Mr. Puneet Bhasin

3. Mr. Jitender Sareen

4. Mr. Satish Mahajan

5. Mr. Anurag Seth

6. Mr. Harpereet Singh

7. Mr. Karan BirSuri

8. Mr. Rajesh Sawhney

9. Mr. Rakesh Sawhney

10. Mr. Ramesh Bhasin

11. Mr.Rakesh Arora

12. Mr.Virender K. Suri

13. Mr.Vijay K Aggarwal

14. Mr. S.B. Sawhney

| Click here to view details |

- Published in Notifications

No. SMTA/JUNE-4/COND. 4th June, 2021

No. SMTA/June.4/COND.

4th June 2021

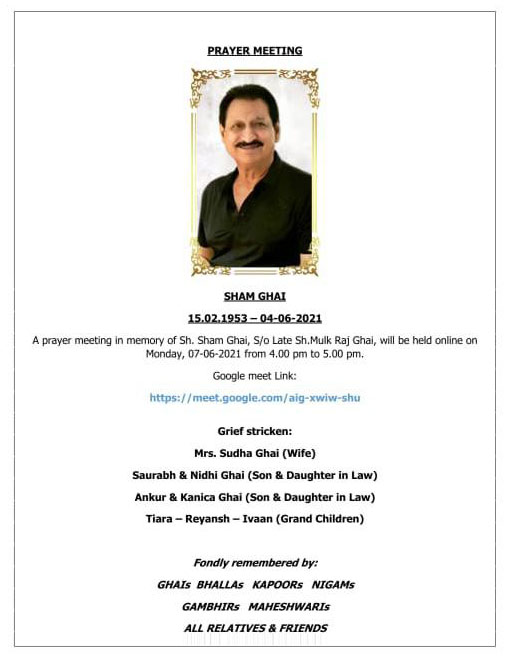

With profound grief & sorrow, we regret to inform you the sad demise of Sh. Shyam Ghai brother of Sh.Krishan Pal Ghai & Sh. Inder Ghai , of *M/S. Avon Surgico Private Limited, New Delhi * on 4th June,2021.

Join the following link

https://meet.google.com/aig-xwiw-shu

- Published in Condolences

SMTA/JUNE2021/Ministry of Chemicals and Fertilizers

SMTA/JUNE2021/Circular

DATE: 3rd June, 2021.

(Published in Part II, Section 3, Sub Section (ii) of the Gazette of India Extraordinary)

Government of India

Ministry of Chemicals and Fertilizers

Department of Pharmaceuticals

National Pharmaceuticals Pricing Authority

New Delhi, 3rd June 2021

ORDER

SO.______________ Whereas the National Pharmaceutical Pricing Authority (NPPA) was established vide Resolution No. 33/7/97-PI.I dated 29th August 1997 of the Government of India in the Ministry of Chemicals and Fertilizers to regulate and monitor prices of drugs/formulations and oversee the implementation of the Drugs (Prices Control) Order (DPCO); and whereas the Government of India by S.O. 1394(E) dated 30th May 2013 and S.O. 1249(E) dated 6th April 2020 in exercise of the powers conferred by Section 3 and 5 of the Essential Commodities Act, 1955 (10 of 1955) has delegated the powers in respect of various paragraphs including paragraph 19 of the DPCO, 2013 to the NPPA to exercise the functions of the Central Government;

A

| Click here to view details |

- Published in Notifications

SMTA/MAY2021/Highlights of 43rd GST Council Meeting

SMTA/MAY2021/Highlights of 43rd GST Council Meeting

DATE: 30h May, 2021.

ANNEXURE

Covid -19 Relief in late fee, Interest by extended due dates of Returns for period , March/QE March, April and May 2021.

| Click here to view details |

- Published in Notifications