SMTA/MAY2021/GST Council Meeting

SMTA/MAY2021/GST Council Meeting

DATE: 28th May, 2021.

The 43rd GST council meeting was held on Friday 28th May 2021.The meeting was chaired by finance minister Nirmala Sitharaman.

HIGHLIGHTS OF THE GST COUNCIL MEETING

1. Import of Covid-19 related goods and equipment for donation to the government or any relief agencies on recommendation of state government will be exempted up to 31st August 21 from IGST. These items already exempted from basic custom duty. Black fungus medicine Amphotericin B will be also exempted from IGST.

2. A group of ministers will be constituted for the relief of Covid-19 related individual items under GST immediately. The GOM shall give its report by 8th June 2021.

| Click here to view details |

- Published in Notifications

No. SMTA/JUNE-4/COND. 4th June, 2021

No. SMTA/June.4/COND.

4th June 2021

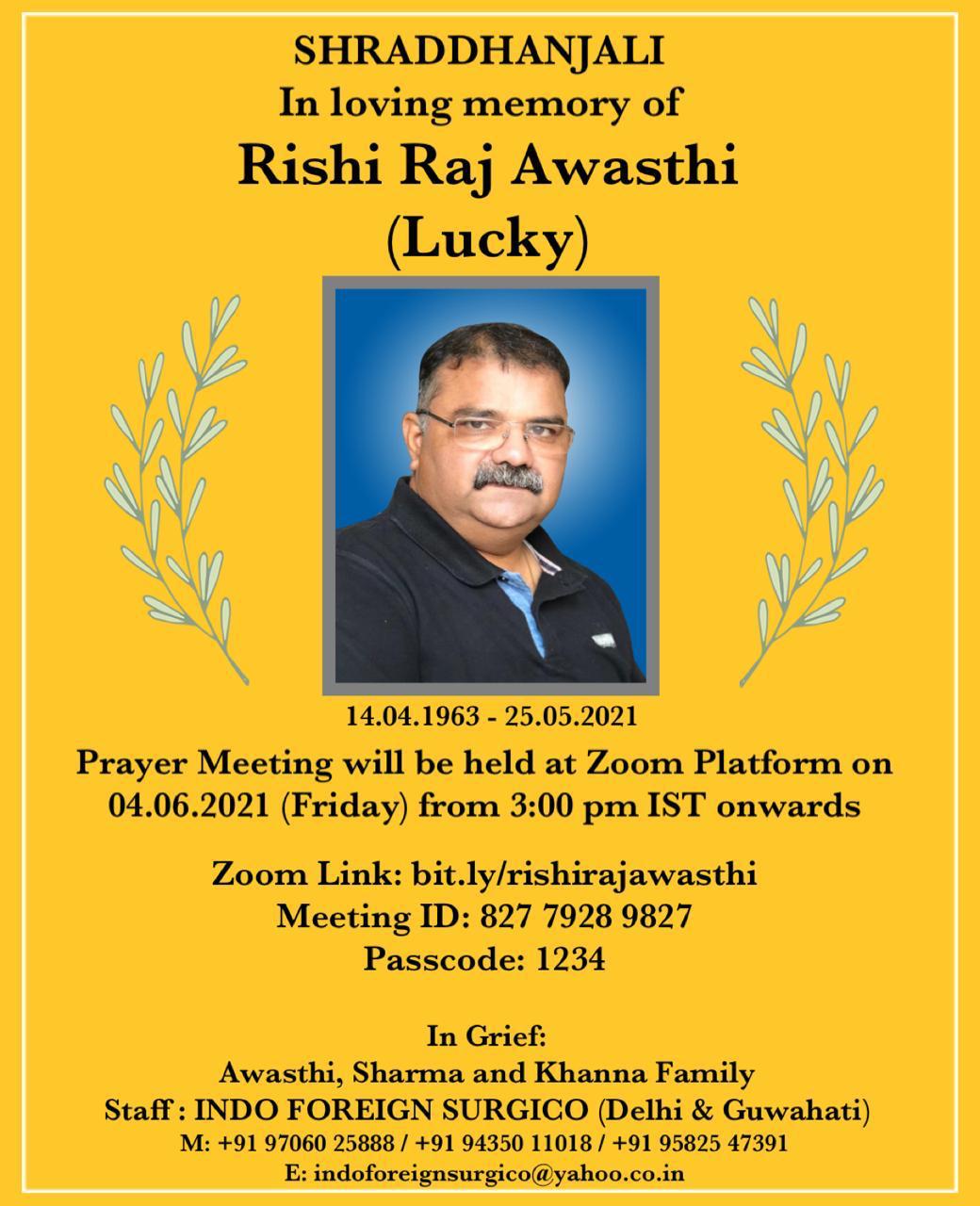

SHARDDHANJALI

In loving memory of Rishi Raj Awasthi (Lucky)

Prayer Meeting will be held at Zoom Platform on 04.06.2021 (Friday) from 3.00 pm IST onwards

Zoom Link: bit.ly/rishirajawasthi

Meeting ID: 827 7928 9827

Passcode: 1234

- Published in Condolences

SMTA/JUNE2021/GST Updates

SMTA/JUNE2021/GST Updates

DATE: 2nd June, 2021.

GST UPDATES

To give effect to the decision taken at 43rd GST Council meeting, GST department has issued few notifications on 1st June 2021…

1. Notification no 16/2021 (payment of interest on delayed filing of GSTR 3B)

Section 50 of CGST Act which governs payment of interest has been amended w.e.f 1st July 2017. Registered person will now be required to pay interest on tax paid through electronic cash ledger. No interest to be paid on tax paid through ITC.

2. Notification number 17/ 2021

The last date for filing GSTR-1 return for May 2021 has been extended till 26th June 2021.

3. Notification no 18/2021

Interest payment for delay in filing GSTR-3b –

A Registered person having turnover of more than Rs 5cr in preceding year – 9% interest p.a. for first 15days after due date of filing of GSTR 3B and 18% interest p.a. thereafter for the month of March, April and May.

B. Registered person having aggregate turnover upto Rs 5cr in last year –

For March 2021 – No interest for first 15 days after the due date of filing of GST 3B, 9% pa for next 45 days and 18% pa thereafter.

For April 2021 – Nil interest for first 15 days from the due date of filing GSTR-3B, 9% pa for the next 30 days and 18% pa thereafter.

For May 2021 – Nil interest for first 15 days from the due date of filing GSTR- 3b, 9% pa for next 15 days and 18% pa thereafter.

C. Registered person filing GSTR – 3b on a quarterly basis – No interest for the first 15 days from the due date of filing GSTR- 3b for quarter March 2021, 9% pa for the next 45 days and 18% pa thereafter.

4. Notification no 19/2021 ( waiver of late fees for GSTR 3B for March, April and May 2021)

a. Registered person having aggregate turnover of more than Rs 5cr in last year –

No late fees for the first 15 days from the due date.

b. Registered person having aggregate turnover upto Rs 5cr –

For March 2021- No late fees upto 60 days from the due date.

For April 2021- No late fees upto 45 days from the due date.

For May 2021- No late fees upto 30 days from the due date.

c. Registered person filing quarterly GSTR- 3b – No late fees upto 60 days from the due date of filing return for March 2021 quarter.

d. Amnesty scheme-

Those who have not filed their GSTR- 3b for any month or quarter from July 2017 till April 2021 can file the return before 31st August 2001 with the late fee of Rs 1000 per return.

If the tax payable in any return is Nil, then the late fees shall be Rs 500 per such return.

e. Maximum late fees for delay in filing GSTR-3b from June 2021 onwards-

If tax payable is Nil then maximum late fees shall be Rs 500 per return

If turnover in the last year is upto Rs 1.50 crore, then maximum late fees shall be Rs 2000 per return.

If turnover in last year is is up to Rs 5 crore, then the maximum late fees shall be Rs 5000.

5. Notification no 20/2021

Maximum late fees for delay in filing GSTR-1 from June 2021 onwards-

If there is no outward supplies during the month/ quarter, then maximum late fees shall be Rs 500.

If the turnover during last year is upto Rs 1.5 crore, then maximum late fees shall be Rs 2,000.

If turnover during last year is upto Rs 5 crore, then maximum late fees shall be Rs 5000.

6. Notification 26/2021 ( Filing of Job Work return)

All Registered person can file ITC 04 for Jan – March 2021 till 30th June 2021.

7. Notification 27/2021 ( Availment of ITC and filing of IFF for April 2021)

a. Registered person can claim ITC for April and May 2021 as per their books without following GSTR 2A. However, while filing GSTR 3B for June 2021, it need to ensure that it has availed ITC for April, May and June, put together , as per GSTR 2A plus 5%.

b. Registered person filling quarterly GSTR 1 can file outward supply details in IFF for May 2021 from 1st June till 28th June 2021. Earlier the due date was till 13th June 2021.

- Published in Notifications

No. SMTA/MAY-31/COND. 31st May, 2021

No. SMTA/May.29/COND.

31st May 2021

With profound grief & sorrow, we regret to inform you the sad demise of Sh. InderJeet Sareen of M/S. Asian Surgical Corp, New Delhi on 29th May,2021.

Prayer Meeting will be held on 31st May,2021, via Zoom Meeting.

Link: https://us04web.zoom.us/j/72117765487?pwd=NlR3K1YzbW0wUngydU5BNkZsbWcwdz09

Meeting ID: 721 1776 5487

Passcode: TA8YTP

Time: 4.00 pm.

- Published in Condolences

No. SMTA/MAY-25/COND. 25th May, 2021

No. SMTA/May.25/COND.

25th May 2021

With profound grief & sorrow, we regret to inform you the sad demise of Sh. Rishi Awasthi younger brother of Sh. Ravi Awasthi & Sh. Ashim Awasthi, of M/S. Indo Foreign Surgico, Guwahati on 25th May,2021.

Keeping the pandemic situation in mind we would request all members to pray for the departed soul.

- Published in Condolences

SMTA/April.2021/EBM/MIN-11

Ref: SMTA/April.2021/EBM/MIN-11

Dated 24-05-2021

MINUTES

Pursuant to the Agenda Notice dated 3rd April, 2021 the 11th Executive Body Meeting of The Surgical Manufacturers and Traders Association was held Online by video conferencing on 11th April, 2021 at 07.00 PM.

Following members were present:

1. Mr. Pradeep Chawla (In the Chair)

2. Mr. Puneet Bhasin

3. Mr. Jitender Sareen

4. Mr. Satish Mahajan

5. Mr. Anurag Seth

6. Mr. Harpereet Singh

7. Mr. Karan BirSuri

8. Mr. Rajesh Sawhney

9. Mr. Rakesh Sawhney

10. Mr. Ramesh Bhasin

11. Mr.Rakesh Arora

12. Mr.Virender K. Suri

13. Mr.Vijay K Aggarwal

14. Mr. S.B. Sawhney

| Click here to view details |

- Published in Minutes of Meeting

No. SMTA/MAY-24/Prayer Meeting

No. SMTA/May.20/COND.

24th May 2021

Prayer Meeting for Sardarni Mrs. Dupinder Kaur Pasricha – Online – Zoom

With profound grief & sorrow, we inform the sad demise of your beloved Sardarni Mrs. Dupinder Kaur Pasricha on 20th May 2021

Keeping the pandemic situation mind, you can join us for the prayer meeting online via Zoom on 24th May 2021, from 11am to 12pm IST.

Zoom Meet ID: 852 1640 1619

Password: 151515

Join Zoom Meeting

https://us02web.zoom.us/j/85216401619?pwd=eU9QYXdpZlJpL2FoR25SUDU0RmdRUT09

In Grief:

Pasricha Family

+91 9300960096

- Published in Condolences

SMTA/MAY2021/Circular

SMTA/MAY2021/Circular

DATE: 23rd May, 2021.

IMPORTANT / URGENT CIRCULAR

Dear Members,

It has come to our notice that some SUB STANDARD Oxygen Concentrators and Pulse Oximeters are being sold in the market. Certain videos are also viral these days showing Oxygen purity at 30% or 40% in Oxygen Concentrators and Pulse Oximeters showing SpO2 level of around 95% even when a pencil or biscuit is inserted instead of finger.

All members are requested to please sell all products of good quality and do not indulge in sub standard or spurious products. It would be further advised to take this matter seriously as the government is likely to initiate a crackdown on importers / dealers / stockists of such spurious pulse oximeters and oxygen concentrator.

This advisory is being issued as to warn our members to safeguard themselves and in interest of the public / users.

Best Regards,

For The Surgical Manufacturer & Trader Association,

(Puneet Bhasin)

Hony. Secretary -SMTA

| Click here to view details |

- Published in Notifications

No. SMTA/MAY-20/COND. 20th May, 2021

No. SMTA/May.20/COND.

20th May 2021

With profound grief & sorrow, we regret to inform you the sad demise of Smt. Dupinder Kaur Pasricha * W/o *Sh. R.S.Pasricha, of M/S. Kay & Company , Delhi on 20th May, 2021.

Keeping the pandemic situation in mind we would request all members to pray for the departed soul.

- Published in Condolences

Extension of time limits of certain compliances to provide relief to taxpayers

20th May 2021

New Delhi, Circular No. 9 of 2021

F.No.225/49/2021-ITA-II

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

Subject: Extension of time limits of certain compliances to provide relief to taxpayers in view of the severe pandemic

The Central Board of Direct Taxes, in exercise of its power under section 119 of the Income tax Act 1961 (hereinafter referred to as “the Act”) provides relaxation in respect of the following compliances.

| Click here to view details |

- Published in Notifications